An Important Warning from Thomas Sowell

A month ago, on March 4, I published an article in the Times Examiner, entitled, “Cautionary Tales of American Tariff History.” This was in response to President Trump’s announced use of tariffs to negotiate corrections to unfair and abusive trade practices that have been foisted on the American government, economy, and our people for decades by dozens of our trading partners, some of which we consider potential enemies, but many of which have been otherwise strong military and political allies. I agree that it is a priority to correct these problems and with Trump that temporary imposition of reciprocal (or retaliatory) tariffs might be useful in negotiating fair and balanced trade. I have also always strongly agreed that critical defense industries must be protected. We do not want to be dependent on imports for national defense. Trump is also correct that a great nation must be a nation with a strong manufacturing sector that makes things rather than just shuffling financial paper.

However, I was alarmed by Trump’s statements indicating that while he was aware of the part tariffs played in making the United States a great industrial power, he and his economic advisers were apparently unaware of or dismissive of the damaging nature of tariffs to other sectors of the economy and the unfortunate consequences of tariffs in American history.

Moreover, Trump has expanded his Tariff Strategy beyond the abusers. His April 2 Liberation Day statement indicated he would place at least a 10 percent tariff on all countries, a total of nearly 200 countries, even many of our closest allies and those who impose no tariffs on us. This suggests that Trump wants to make tariffs the major U.S. tax revenue source, replacing perhaps income taxes. I am sure this sounds good to the American people, but we had such a system from 1795 to 1913 which by 1824 had deteriorated into political corruption, strife, and blatant sectionalism that kept entire regions of the United States impoverished for generations. I have detailed some of this in my March 4 article, Cautionary Tales of American Tariff History - The Times Examiner. These were the consequence of Henry Clay’s “American System” of tariffs and government subsidies.

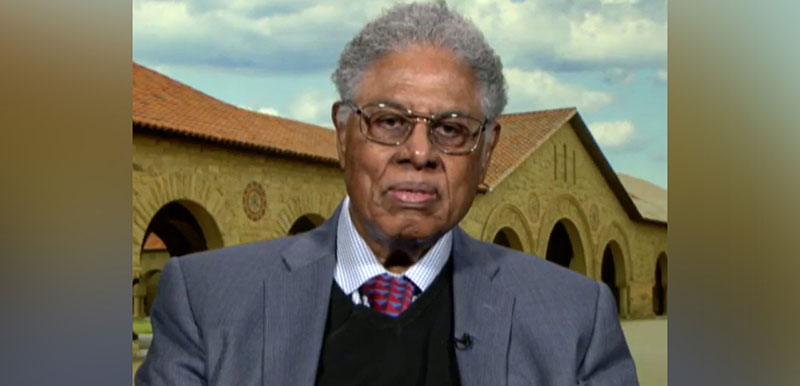

On April 3, legendary conservative economist, Thomas Sowell, in an interview published by Economy, warned that sweeping tariffs risk triggering a trade war and repeating the "devastating history" of trade policies that worsened the Great Depression.”

On April 1, Sowell was interviewed by the Hoover Institute’s Peter Robinson on Uncommon Knowledge. In an excerpt from the interview, which will not be fully released until April 15, Sowell referenced the Smoot-Hawley tariffs, which were broad tariffs debated and implemented in 1929 and 1930, respectively, in an effort to protect American industries from overseas competition in the early stages of the Great Depression. Foreign countries retaliated, causing a decline in global trade that economists now widely believe deepened the Depression. He went on to say that if Trump's tariffs are intended as short-term, limited measures to achieve strategic goals, they may be effective, but if they're left in place over the long term, they could replicate the "devastating history" of a global trade war and cause consumers and investors to pull back amid the uncertainty. Sowell further stated:

"It's painful to see what a ruinous decision from back in the 1920s being repeated. Now insofar as he's using these tariffs to get various strategic things settled and that he's satisfied with that," Sowell said, "but if you set off a worldwide trade war, that has a devastating history. Everybody loses, because everybody follows suit, and all that happens is you get a great reduction in international trade."

The stock markets expressed grave reservations and uncertainty on Trump’s elaborated Tarriff Strategy. On March 3 the Dow Jones Industrial index closed down more than 1,660 points and on March 4 closed down 2,231 points. According to the Wall Street Journal, Trump’s tariffs wiped out over $6 trillion in an epic two-day rout. This decimation of American financial assets could push the country toward recession.

It is worth repeating some paragraphs of my March 4 article for a general education on the negative aspects of tariffs.

It may be a surprise to most Americans not familiar with some of the underlying economic issues of the Civil War that massive increases in tariffs passed by Congress for the benefit of Northern industrial states were a major incentive for Southern secession. Read my book, The Un-Civil War: Shattering the Historical Myths and my Times Examiner articles on the Morrill Tariff of 1861.

Mark Thornton and Robert B. Ekelund Jr. in their 2004 book on the economics of the Civil War, summarize some of their general economic conclusions. Protective tariffs benefit some commercial or regional interests in the short to intermediate term, but they do more harm than good to the overall economy. Obviously, some interests are injured. Tariffs are essentially a redistribution of wealth through political means. Protected economic interests often become non-innovative drags on the economy and taxpayers.

While protectionist tariffs benefit selected industries or commercial interests, they punish everybody else. The higher prices charged by protected business interests are passed on to consumers and other businesses whose purchasing power and standard of living are thus lowered. Their reduced purchasing power reduces demand for consumer products and negatively impacts employment demand.

It is also important to understand the dynamics of using tariffs for government revenue. Here is a very simplified illustration. If we place a 20 percent tariff on $10 billion worth of aluminum cookware from Widgetland, we are unlikely to receive $2 billion in tariff revenues. U.S. aluminum cookware manufacturers will now be more competitive in price, and U.S consumers will buy more domestically manufactured aluminum cookware. The domestic manufacturers will probably be able to raise prices as much as 20 percent. American consumers will pay higher prices, but most of it will go to American firms, who with higher profits will be able to expand production and employment. Tariff revenues will fall as U.S. manufactures gain more market share. Presumably, the U.S. government will raise some revenue from expanded profits in the aluminum cookware industry. However, tariff revenue will go down. Both consumers and businesses that use aluminum cookware will experience higher aluminum cookware prices. The advantage is that U.S. manufacturing firms and employment will grow. But higher prices resulting from increased price flexibility by tariff-protected U.S. manufacturers and tariff revenues will increase business expenses in non-protected commerce and increase retail cookware prices. Who profits from this? Protecting national security interests must remain a priority. Otherwise, those profit the most who have the most political influence and power in Washington.

Protectionism is particularly hard on exporters. Besides their direct effect on the cost of doing business, tariffs negatively impact the exchange rate at which exports can be exchanged for products burdened with increased tariffs. In effect, not only are the exporters’ costs at home increased, but they are also likely to get less for their product on exchange. Furthermore, exporters often face retaliatory tariffs that result in lost business and even lost markets. Protectionism also tends to promote the dominance of self-serving political corruption.

Here is my abbreviation of the facts of the Republican Smoot-Hawley Tariff passed on June17, 1930, near the beginning of the Great Depression. Smoot-Hawley was the highest tariff bill in U.S. history. Its stated purpose was to protect suffering American workers, farmers, and businesses from foreign competition. Until then, exporters were faring well and remained a relative strength in the economy. As could have been predicted by historical experience, exports soon suffered, dropping 61 percent, and even Canada introduced a retaliatory tariff against U.S. goods. Unemployment was at 7.8 percent when Smoot-Hawley passed and jumped to 16.3 percent in 1931 and peaked at 25.1 percent in 1933. Protectionist tariffs are generally harmful to economic growth and are essentially a political means of redistributing regional and commercial wealth. Republicans have become much more favorable to free-trade since then, but the delusions of Henry Clay’s American System of tariffs and industrial subsidies still dominated their economic thinking in the 1930s.

Henry Clay (1777-1852) was one of the most influential men in American history. A brilliant Kentucky lawyer, gifted negotiator and politician, and skilled orator, Clay served three times as Speaker of the U.S. House, and twice represented Kentucky in the U.S. Senate. He ran for President in 1824. He lost but was appointed Secretary of State by John Quincy Adams. He founded the Whig Party and ran for President again in 1832 and 1844, losing both times. He continued to dominate the Whig Party and spent the last three years of his life as a Whig political leader and U.S. Senator. He is best known for advocating his American System of Economics, which included a strong national bank (and fiat printed money), corporate business and industrial subsidies to promote growth, and especially, high protective tariffs, favoring manufacturing over agricultural and other commercial interests. In this regard, he was a major influence on Abraham Lincoln’s economic thinking. The American system was basically big government intervention into the economy to spur growth. It differed significantly from a classical free market system driven by free price movements to adjust supply and demand. History has proved that free markets and free trade are far better creators of growth than government intervention. Nevertheless, government systems of intervention have a powerful appeal to ambitious politicians and voters with little knowledge or understanding of basic economics.

Republicans need to review the errors, dangers, and history of Henry Clay’s American System, which was essentially economic policy determined by big government and big business. Caution should be exercised on the use of tariffs.

Finally, I will repeat again an economic study that underscores the basic dangers of high tariffs.

In a 2006 study using mathematical regression analysis, Douglas Irwin analyzed the impact of the 30 percent average tariff during the year 1885. He found that protected industries were not able to increase their profits by the full 30 percent because the higher prices caused by the tariff increase also increased their costs. Their net profit increase through government protection was thereby reduced to about 15 percent, which explains why they kept crying for still higher tariffs. Irwin’s study found the tariff reduced exporter profits by about 11 percent. The total redistribution of income across commercial interests and regions was a whopping 9 percent of total GDP.

The Trump Tariff Strategy, if not resolved quickly. will result in visibly higher consumer costs. Higher consumer costs and the devastation of stock-market related IRA and 401-K accounts could severely undermine Republican ability to maintain House and Senate majorities, which could jeopardize the considerable achievements made so far by the Trump Administration.

Mike Scruggs is the author of two books: The Un-Civil War: Shattering the Historical Myths; and Lessons from the Vietnam War: Truths the Media Never Told You, and over 600 articles on military history, national security, intelligent design, genealogical genetics, immigration, current political affairs, Islam, and the Middle East.

Mike Scruggs is the author of two books: The Un-Civil War: Shattering the Historical Myths; and Lessons from the Vietnam War: Truths the Media Never Told You, and over 600 articles on military history, national security, intelligent design, genealogical genetics, immigration, current political affairs, Islam, and the Middle East.