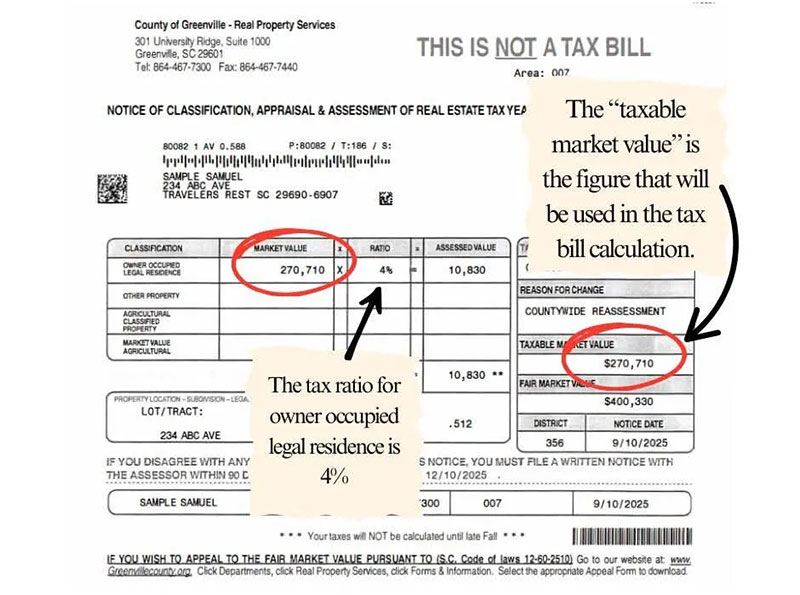

Many have recently received a reassessment notice. This is not the same thing as a property tax bill, though many people understandably are confusing them. Here’s how it works in Greenville County, what drove recent changes, and why the notice may look scary even when your tax bill doesn’t increase proportionately.

How Reassessment Works in Greenville County

- Every five years, Greenville County conducts a county-wide reassessment of property values. This is to ensure that properties are taxed more fairly, reflecting current market conditions.

- Under South Carolina law, for most residential and other properties, there is a 15% cap on how much the taxable value can increase from the prior value due to reassessment. This means your taxable value cannot jump more than 15% simply because of the county-wide reassessment.

- Some properties do not qualify for that 15% cap or are not capped fully. Reasons include:

- The property was sold or transferred in the previous year. In those cases, the “point-of-sale” market value becomes effective.

- Newly added to the tax rolls, new construction, or major improvements. These may be valued at full market value or have less of the cap benefit.

What’s the Millage Rate & “Rollback Millage”

- Millage rate = the tax rate per thousand dollars of assessed/taxable value set by Greenville County plus any schools, municipalities, and other taxing jurisdictions. After reassessment, even though property values have increased, counties are legally required to implement a millage rollback. This is to help offset value increases so that tax bills don’t automatically soar just because assessed values go up.

- The rollback means the rate at which properties are taxed may be lowered to keep total revenue roughly in line with what it was before reassessment, unless Council or voters approve increases. If the county wants to raise taxes beyond that, that requires separate action. We lowered the millage rate by 2 mills in the last budget, and hope to continue that trend in the upcoming one, so this will not be a factor to any increases occurred during reassessment.

Why Your Notice Looks Like a Big Jump, But Your Tax Bill May Not Be

- The notice shows your reassessed value. Because market value has increased significantly in many areas, that number can be much higher than what you paid or what was shown previously.

- However, due to the 15% cap, most people will not see their taxable value increase by more than 15% in a reassessment year. So although your market value is up, the amount used to calculate your taxes is more gradual.

- Then, with the millage rate adjusted downward (rollback), your tax bill may rise less, stay about the same, or in some cases even decrease (depending on other jurisdictions, exemptions, and taxing authorities) than what you fear from just looking at value alone.

What You Should Do

- Double-check whether your property was subject to an Assessable Transfer of Interest (ATI) or had recent improvements, because those may cause your property to be treated differently, and possibly lose the cap.

- Make sure you have applied for all exemptions you may qualify for (homestead, agricultural, etc.). These can reduce taxable value.

- When your tax bill arrives, compare taxable value × millage rate. If you believe your assessment is inaccurate, Greenville County has processes to appeal or ask for a review.

If you have questions about your notice, need information about exemptions, or want help understanding your bill, you can find valuable info and contacts to Real Property Services HERE