Why Some Residents May See Higher Increases, and How Council is Working to Protect Taxpayers

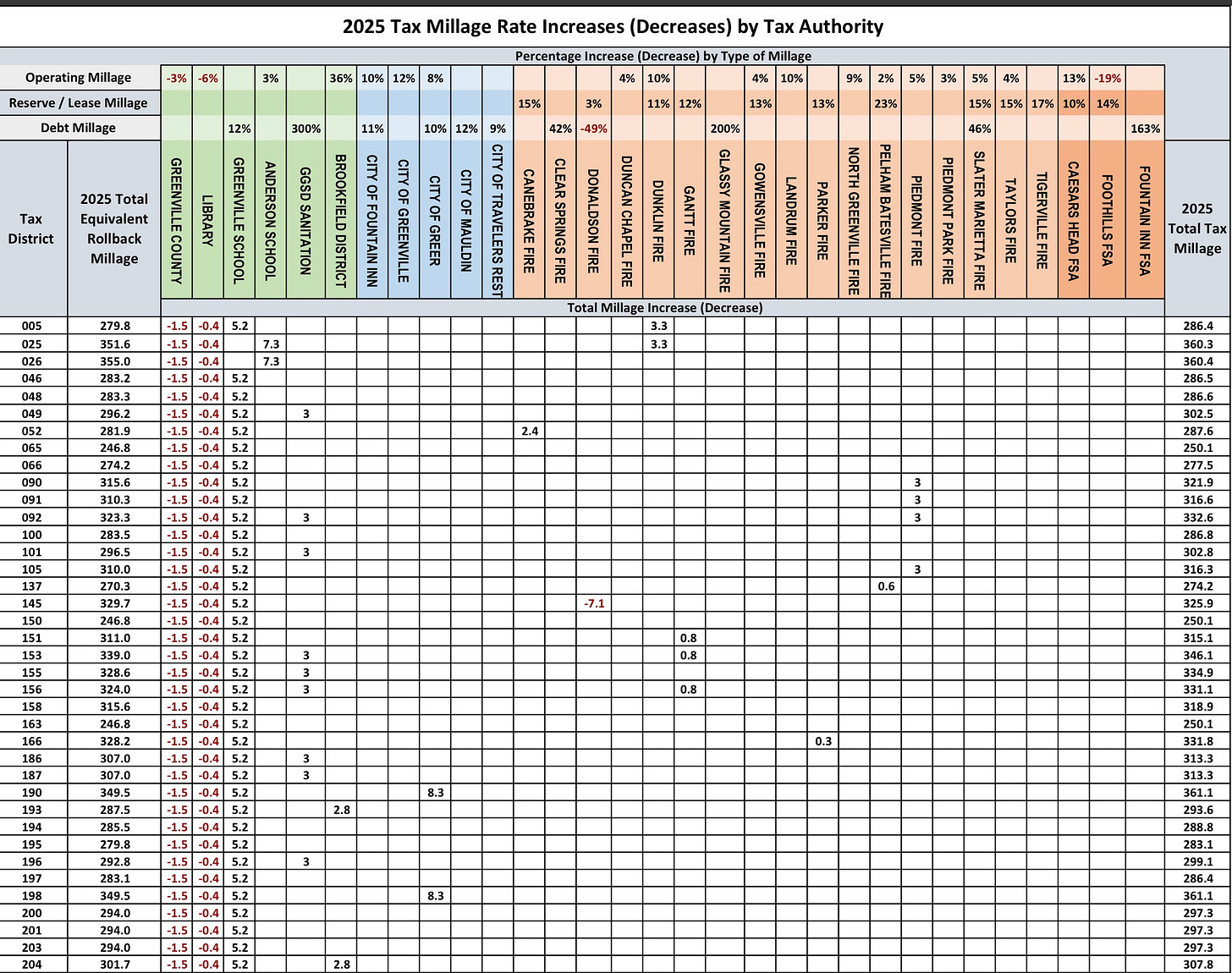

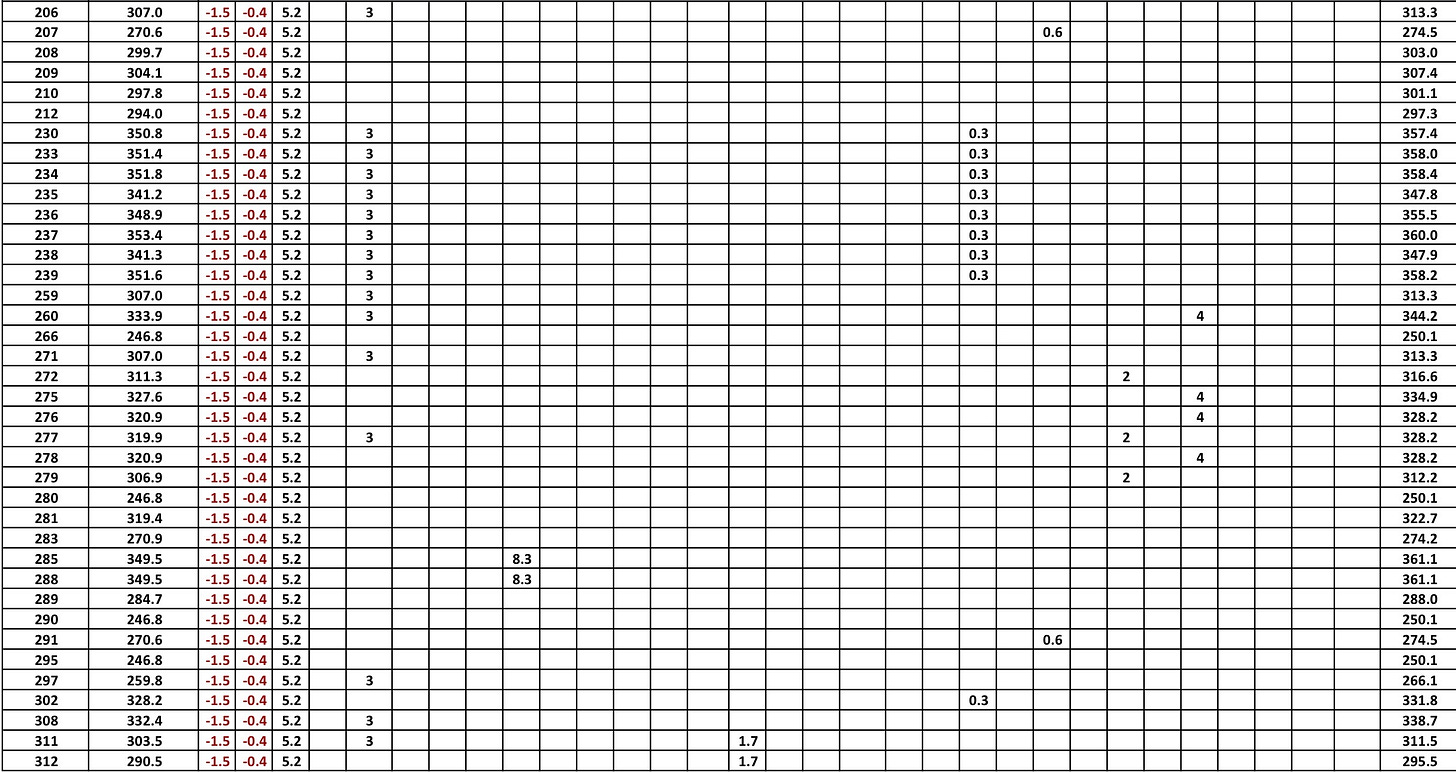

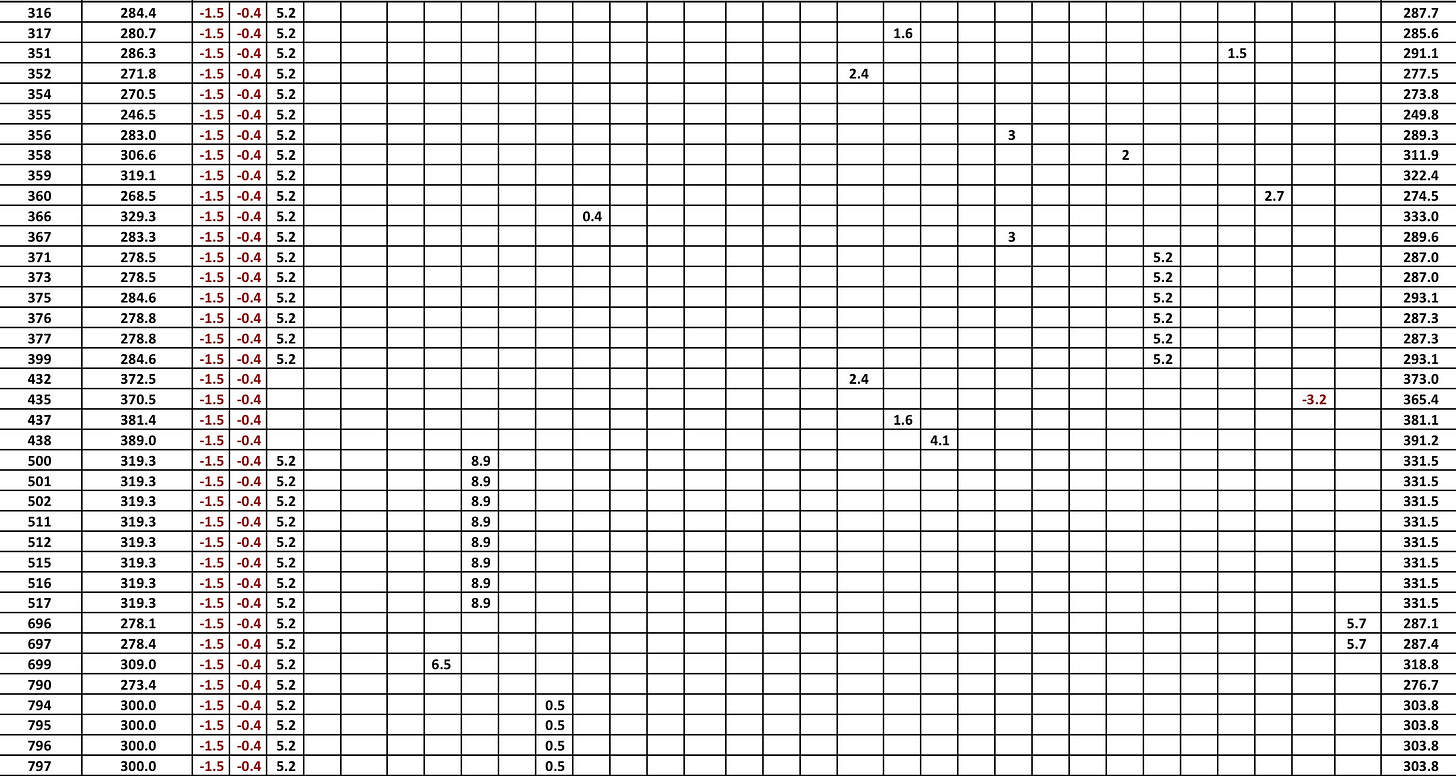

Property tax bills are officially going out, and many residents are beginning to notice differences in the amount they owe compared to last year. On average, property taxes across Greenville County are increasing between 4% and 12%, depending on where each property is located.

It’s important to note that Greenville County Council did not increase county property taxes in the last budget and I believe that will continue to trend this year. In fact, during last year’s budget, Council voted to lower the County’s property tax rate by 1.5 mills, a reduction that will amount to more than $4 million in tax relief for residents. That decision came directly from a clear message we heard from citizens: these times are tough enough without an increased tax burden.

During this year’s reassessment, the County’s millage rate was lowered to account for higher property values. However, other taxing entities, including municipalities, fire districts, and special service districts, made their own millage adjustments. Those independent changes are the main reason some taxpayers are seeing higher total bills, even though the County did not raise its rate.

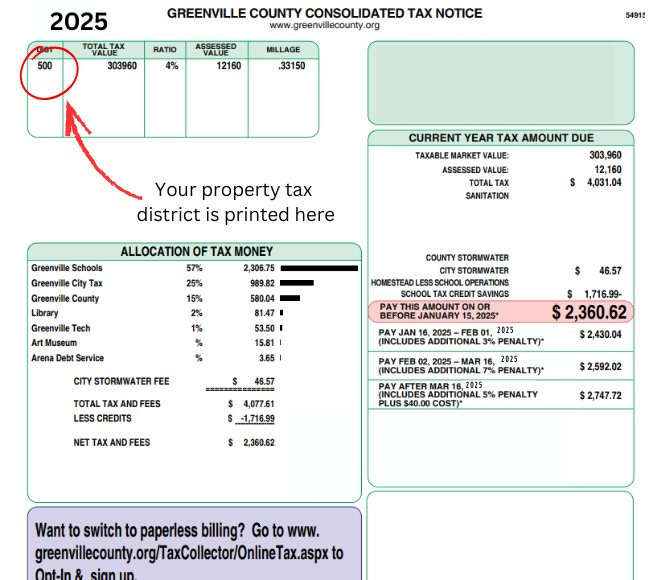

To get started, on your tax bill, the district number is printed in the upper-left corner.

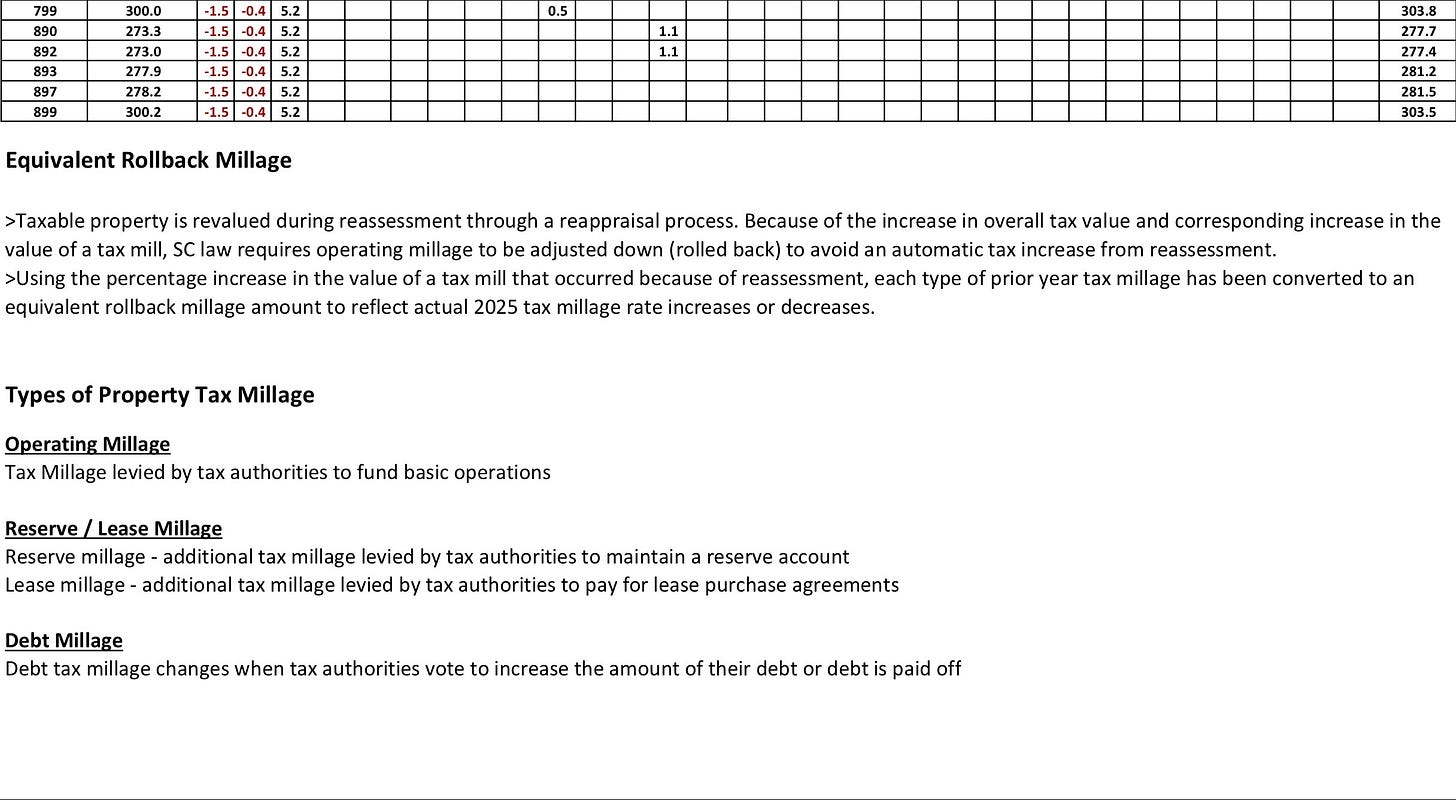

To help clarify where changes occurred, the Greenville County Auditor’s Office, led by Auditor Scott Case, created and published detailed charts (below) showing all 2025 millage rate changes by tax district.

You can also see these charts by clicking the link below: View Millage Changes by District (Greenville County Auditor)

I want to personally thank Auditor Scott Case and his team for going above and beyond to provide this information and help residents better understand how property taxes are calculated. Their transparency and communication make a complicated process much clearer for everyone.